Our Offshore Wealth Management Diaries

Wiki Article

Offshore Wealth Management - An Overview

Table of ContentsSee This Report on Offshore Wealth ManagementWhat Does Offshore Wealth Management Mean?Some Known Factual Statements About Offshore Wealth Management The Greatest Guide To Offshore Wealth Management

Global investors aiming to gear up their properties, wealth, and also investments choose to proceed in advance with offshore financial investments. The offshore industry offers excellent flexibility to global investors to come forward and spend in offshore wealth monitoring.This overview will certainly aid you to understand the core basics needed for overseas wealth monitoring. Offshore investment transforms out to be one of the driving tools that has been widely chosen by organization financiers around the world. Because service capitalists have extensively accepted the concept over a period, many nations have changed themselves right into preferred offshore territories.

The records discussed above need to be handed over to the designated organization consultant. Once submitted, the files undertake the verification process. When validated as well as accepted, you can wage the bank account procedure. offshore wealth management. To recognize more about offshore banking, read our most recent overview on the benefits of offshore financial.

This involves taking steps to maximise the preservation as well as successful transfer of your estate to beneficiaries and recipients. In doing this, you require to consider who you want to gain from your estate, just how and also when they must receive the benefits, and also in what percentages. You ought to likewise recognize individuals and/or firms that you would like to be in cost of managing the distribution of your estate in a professional as well as reliable manner.

The Definitive Guide to Offshore Wealth Management

Liquidity planning likewise forms component of appropriate distribution of your estate, to make sure that successors can obtain the advantages in a timeous, reasonable, and also efficient manner. Rich individuals can benefit from the selection of solutions which riches administration accounts have to supply. A lot of these services may be offered in your house country, but to maximise your advantages and also obtain the ideal wide range monitoring solutions, it deserves thinking about making use of an offshore riches monitoring method.

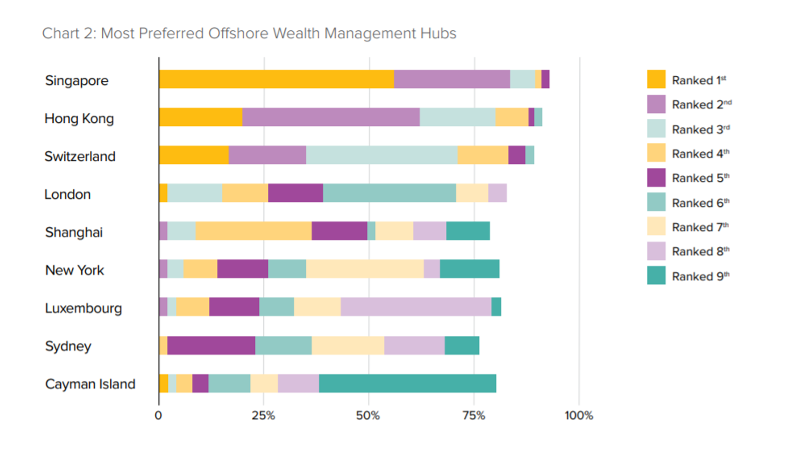

Singapore has a fantastic reputation as a leading offshore banking jurisdiction for high net worth individuals.

Telecom as well as mobile banking in Singapore are highly innovative Although Malay is officially the nationwide language, English is in reality the most extensively used and also is the lingua franca click here to read amongst Singaporean citizens. Regrettably, there are constraints for United States residents for opening up an account in Singapore, which limits the solutions as well as investment choices available.

This makes it one of the most accessible overseas banking jurisdictions in Europe. Luxembourg is most widely known for their high-grade investment banking services.

Offshore Wealth Management for Dummies

A Luxembourg offshore account can be opened up remotely within about 2 weeks. This is a small price to pay for the range of benefits that a Luxembourg wide range management account offers.It is extremely a good idea to this contact form enlist the solutions of an experienced and competent overseas wealth supervisor to assist you assess as well as determine the most ideal options which are readily available to you. They can likewise make certain that the arrangement process is smooth and effective.

Below are some of the benefits of offshore asset administration that financiers need to understand. There are countless overseas trust funds property protection that are especially associated with the service of protecting assets. If a specific suspects that their money is at threat, they can rapidly move a section of their riches or assets to an offshore firm for security objectives.

The Facts About Offshore Wealth Management Uncovered

Offshore jurisdictions provide the advantage of privacy legislation. The majority of the nations that are proffered for overseas financial you can try these out have actually already implemented regulations establishing high standards of financial confidentiality. There have actually been severe consequences for the offending events in the past, especially when privacy is breached. Divulging investors quantities to a breach of business privacy in some overseas territories.

When it comes to cash laundering or drug trafficking, offshore regulations will certainly allow identity disclosure. Nations have ended up being experienced at shielding their markets versus exploitation by international investors. Some capitalists, specifically those that want a massive and also varied portfolio, really feel limited by these markets. However, offshore accounts to not have any type of constraints.

They have proved to be some of one of the most rewarding markets where capitalists can rapidly expand their investments. Together, a lot of the offshore accounts are in developing countries where there are thousands of financial investment opportunities as well as untapped capacity. Several of the governments are beginning to privatize some of the industries, which is giving financiers an opportunity to obtain significant financial investment opportunities in these growing consumer markets.

Report this wiki page